Self-catering holiday homes: movement between non-domestic rating and Council Tax valuation lists

Published 17 December 2024

Details

Applies to England and Wales��

The release will look at self-catering holiday homes (also known as holiday lets) that have been deleted from the non-domestic rating lists in England and Wales between 2019-20 and 2023-24 and review how many of these have been inserted into the Council Tax valuation list in the same period.����

Statistical enquiries ��

Date of next publication ��

This is an ad-hoc publication. ��We currently have no plans to update, if this changes in the future an announcement will be added to�� our��announcements page.

1.�������dzܳ� this release��

This report relates to England and Wales only. Property valuations are not carried out by the Valuation Office Agency (VOA) in Scotland and Northern Ireland, where the valuation law and practice differ from England and Wales.��

We recognise this area is of interest to users of both our Council Tax (CT) and non-domestic rates (NDR) statistics. ��The information in this report aims to help guide users of VOA’s official statistics (for both CT and NDR) to interpret some of the related numbers in those publications. Though it is not yet possible to establish a suitable assured methodology that could be incorporated directly into the official statistics, the report will provide an explanation and provisional best estimate of self-catering holiday homes moving between the NDR and CT lists.

2.���������첵���dzܲԻ���

2.1.����Բ��� in self-catering eligibility rules for non-domestic rates��

From April 2023,��new eligibility rules��for non-domestic rates (also known as business rates) were applied to self-catering properties in England and Wales.��If these rules are not met, properties will become eligible for paying Council Tax.��

These eligibility rules are different depending on if the property is in�����ǰ���.��

��To be eligible for non-domestic rates, from 1 April 2023 in England, the property must be:��

- available for letting commercially for short periods that total 140 nights or more in the previous and current year.��

- actually let commercially for 70 nights or more in the previous 12 months.��

To be eligible for non-domestic rates, from 1 April 2023 in Wales, the property must be:��

- available to let commercially for short periods that total 252 nights or more in the previous and current year.��

- actually let commercially for 182 nights or more in the previous 12 months.��

Prior to 1 April 2023, self-catering properties in Wales were required to be available for 140 nights and actually let for 70 nights.

2.2�����ڴھ��������� Statistics

VOA publish annual Official Statistics regarding the��Non-domestic rating: stock of properties�����Ի���Council Tax: stock of properties.��

Non-domestic rating: stock of properties��

The statistics provide information on the number and value of the stock of rateable properties (known as ‘hereditaments’), broken down by sector, geographic location, special category (SCat), property type and rateable value band.��

Information is given on the number of rateable properties and total, mean and median rateable value in England and Wales by Special Category code in the ‘Stock Scat’ table.

Further breakdowns are available in the ‘Stock Scat Tables by region, county, local authority district, and rateable value band’ table. ��Users can find information on self-catering holiday homes in these tables by looking for the ‘Holiday Homes Self Catering’ special category code.��

In the 2024 release, an additional table was included detailing counts of the main types of changes to the rating list i.e. insertions, deletions, reconstitutions.��While this allows users to see the high level reason for change in the non-domestic rating list, it does not give detailed reasons to what caused the change, or the type of property within each reason.��Further analysis of these figures identified that of the 55,500 properties deleted in 2023-24, 11,870 (21%) were self-catering holiday homes.

Council Tax: stock of properties��

The statistics provide information on the number and type of domestic properties (known as “dwellings”), as well as the insertions into and deletions from the Council Tax valuation lists.��

Information is given regarding the number of properties inserted into the Council Tax list in table ‘CTSOP5.0’. This table gives detailed reason for why a property is inserted into the list. ��‘Change in use: New to Council Tax list’ and ‘Change in use: return to Council Tax list’ account for properties that have moved from the non-domestic rating list to the Council Tax list. However, this table does not give the type of property.

3.��Methodology��

3.1.��Challenges with linking NDR and CT data��

VOA are required to maintain rating lists specifying a rateable value for each relevant non-domestic rateable property in England and Wales.��They also are required to maintain valuation lists specifying the Council Tax bands dwellings should be placed in to. ��These are separate lists, which are not linked together. VOA assign identifiers to each property which are specific to the NDR or CT list.��

Within VOA data properties will have one or more identifiers that could be used.��

- Unique Property Reference Number ()��

- VOA unique identifier��

- Address

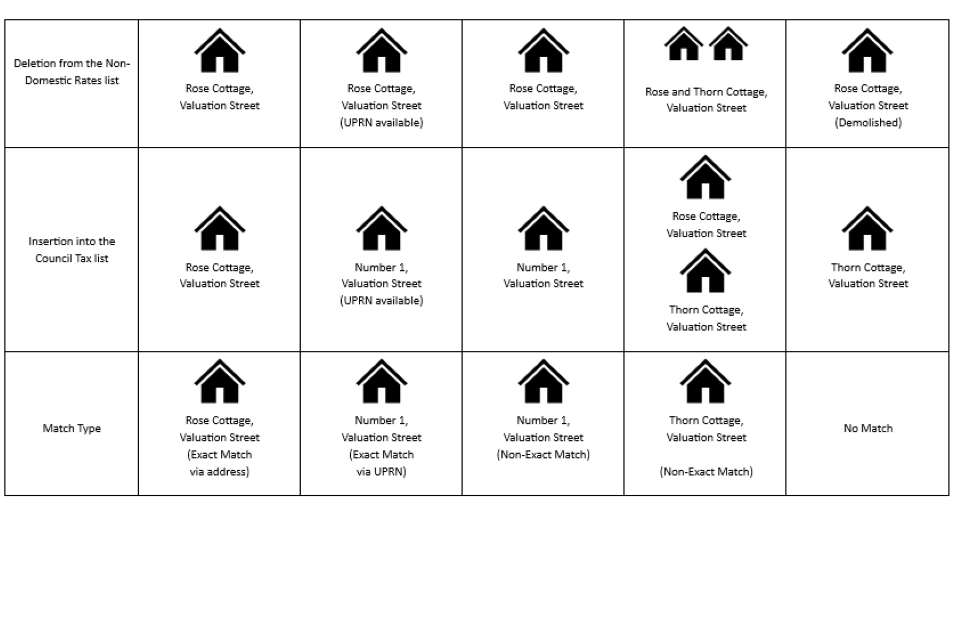

There are challenges with using each of these identifiers where information is missing, or addresses may change between systems. ��Examples of how properties are matched are shown in Figure 1.1.

Figure 1.1: A visualisation of the types of matches between deletions from the NDR list and the CT list

3.2.��How the matching works��

Properties deleted from the NDR list that have been identified as a self-catering holiday home (using the VOA primary description of “self catering holiday unit and premises”) in each financial year are compared to the insertions into the CT list over the same time period.����

Properties are initially matched using their UPRN (Unique Property Reference Number), however this information is not available for a lot of these properties.�� If there are multiple insertions within the same postcode as a deletion then the insertion with the closest address, via Levenshtein distance, is used.����

Of all of the properties that have been matched, 66.2% are exact matches. These are properties which have been matched by UPRN or where the full address in both lists are identical. Additional matches that are not exact can still be correct due to property name changes or formatting differences.

3.3���ϳܲ������ٲ�

Additional checks were done on the non-exact matching properties to improve their reliability. Such checks include removing any match which was found to be a deletion due to a demolition, address change or a boundary change. The non-exact matches that were linked to an insertion with a CR03 report code (new property) were also removed. Manual checks were carried out to ensure that non-exact matches were still correctly matched.����

We also considered including properties that were inserted into the CT list after 31 March 2024 for matching, as this would allow for any time differences between deleting and inserting a property. In practice, it was found that the unmatched properties were deleted equally throughout the financial year therefore using these additional insertions will have a minimal impact on the results and were therefore not included in the final results.��

The figures presented in the results section were also created using only the exact matches. The proportion of properties in each Council Tax band for both England and Wales remained consistent with the results using only exact matching properties and all matching properties.

3.4���³� data is not included

This data focuses on deletions from the NDR list where the property is defined as a self-catering holiday home. High level information is available to give the reason for deletion, for example ‘cease to be rateable’, however this does not give further detail to why the property was no longer rateable, or how many nights the property has been let for in the past.��

VOA require holiday let owners to����to determine if the eligibility rules have been met. This information is used by VOA operations to maintain accurate rating lists, however it is not available in a suitable format to be analysed on a large scale.��

It is possible that a property is split into several properties or merged together to form one property on each list. This analysis looks for a 1 to 1 link between the properties on the two lists.��If a property is deleted on the NDR list, and then reinserted as two properties on the CT list, this analysis will only count one of the properties on the CT list.

4.��Results

4.1��2023-2024 Headline Figures��

11,960 self-catering holiday homes were deleted from the NDR list in the 2023-24 financial year.����

This does not match the��non-domestic rating: stock of properties��publication as it reflects all properties categorised as “self catering holiday unit and premises” using the VOA primary description code rather than special category code. Further details regarding primary description and special category codes can be found in the��background information��of the NDR stock of properties publication.��

10,230 (85.6%) of these deletions were matched to an insertion on the CT list. ��It is not expected that every deletion will appear in the CT list as some properties will be deleted for other reasons, such as demolition.����

England had 10,710 self-catering holiday homes deleted from the NDR list in 2023-24, with 9,280 (86.7%) matched to an insertion on the CT list.����

The South West of England is the region with the most self-catering holiday homes. This region also had the highest number deleted (3,520). 3,110 (88.3%) of these were matched to an insertion on the CT list.��

Wales had 1,240 self-catering holiday homes deleted from the NDR list in 2023-24, with 950 (76.3%) matched to an insertion on the CT list.

4.2���鲹�ٱ����� value of deleted self-catering holiday homes

The vast majority (95.6%) of self-catering holiday homes deleted from the NDR list in 2023-24 had a rateable value of less than £6,000.

4.3����dzܲԳ����� Tax band of self-catering holiday homes

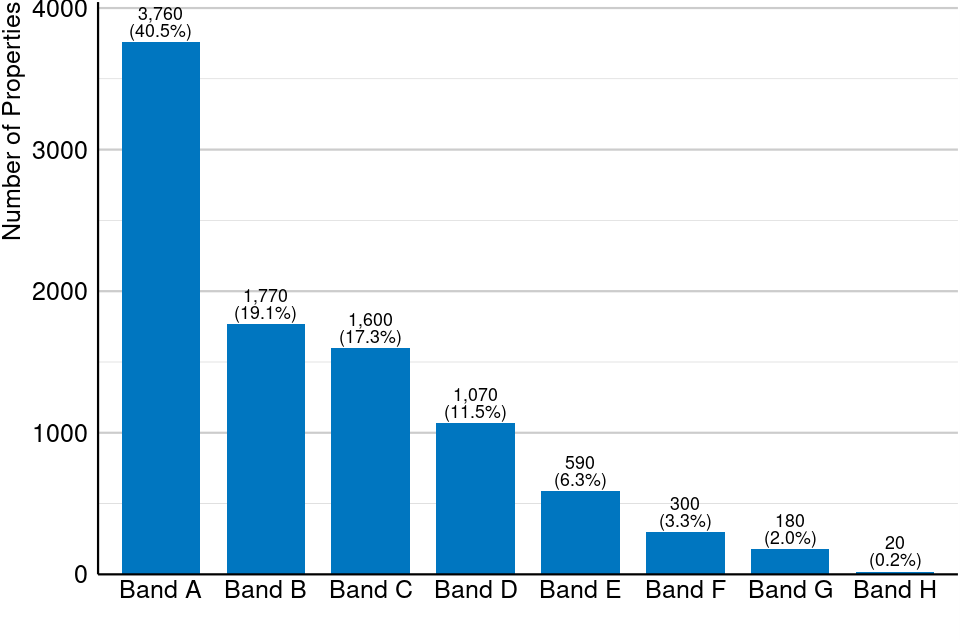

Figure 2.1: The number of former self-catering holiday homes by Council Tax band in England, 2023-24

Source: Table 5: Self catering holiday homes inserted into the Council Tax list by Council Tax band and region, 01 April 2023 to 31 March 2024��

Figure notes: Counts are rounded to the nearest ten. Percentages are rounded to one decimal place.

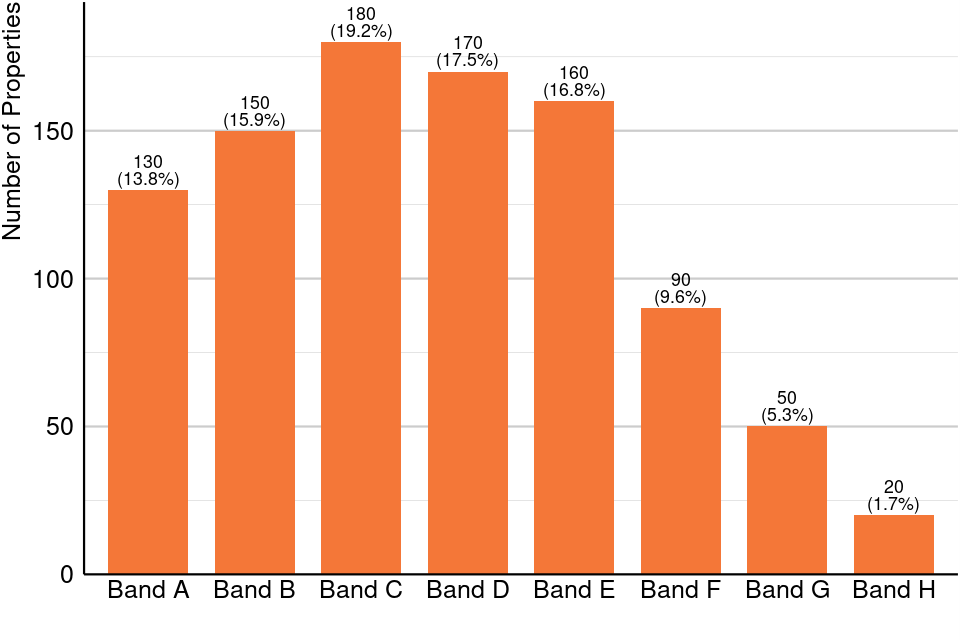

Figure 2.2: The number of former self-catering holiday homes by Council Tax band in Wales, 2023-24

Source: Table 5: Self catering holiday homes inserted into the Council Tax list by Council Tax band and region, 01 April 2023 to 31 March 2024��

Figure notes: Counts are rounded to the nearest ten. Percentages are rounded to one decimal place. Any count under five is redacted, meaning band I properties are not shown.��

Figure 2.1 shows that in England, the most frequent CT band for previously self-catering holiday homes was band A (3,760 properties, 40.5%), followed by band B (1,770, 19.1%). Band A is also the most frequent CT band in the overall stock of properties for England.��

Figure 2.2 shows that in Wales, the most frequent CT band for previously self-catering holiday homes was band C (180 properties,19.2%) followed by band D (170, 17.5%). Band C is also the most frequent CT band in the overall stock of properties for Wales.��

In both countries, the highest band contained the fewest previously self-catering holiday homes, with 20 (0.2%) properties in band H in England and less than five properties in band I in Wales.

4.4���վ��������������

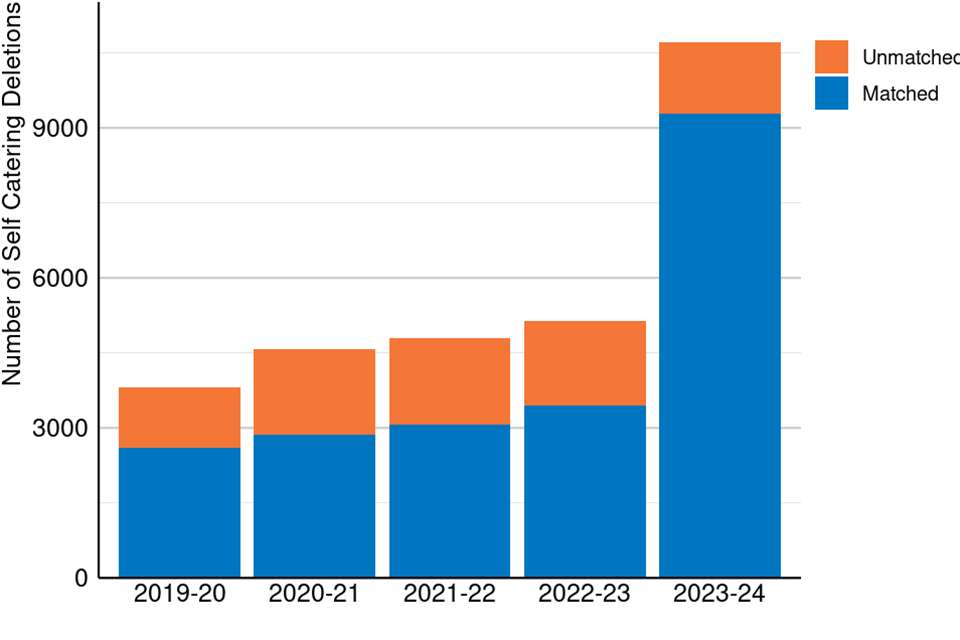

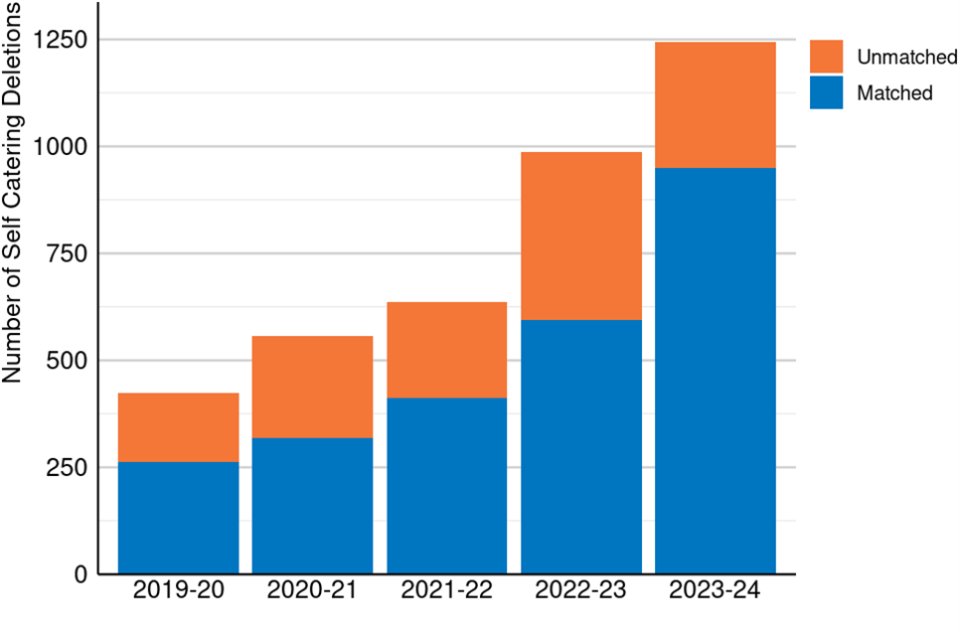

Figure 3.1: Self-catering property deletions by financial year in England

Source: Table 1: Self catering holiday homes deleted from the non-domestic rating lists, by region, 01 April 2019 to 31 March 2024

Figure 3.2: Self-catering property deletions by financial year in Wales

Source: Table 1: Self catering holiday homes deleted from the non-domestic rating lists, by region, 01 April 2019 to 31 March 2024��

Figure 3.1 shows that the number of deletions of self-catering holiday homes in England almost doubled between 2022-23 and 2023-24 financial year.������

Figure 3.2 shows that there were larger increases in deletions of self-catering holiday homes in Wales during the 2023-24 and 2022-23 financial years.����

This is in line with the change to eligibility criteria.������

In both countries there is always a proportion of deletions that are not able to be matched to an insertion to the CT list. These unmatched self-catering holiday homes could have been deleted for other reasons than being moved to the council tax list, for example demolitions or address changes.

5.��Further information

/government/news/changes-to-business-rates-rules-for-self-catering-properties��

����

��

The Non-Domestic Rating (Definition of Domestic Property) (England) Order 2022����

The Non-Domestic Rating (Amendment of Definition of Domestic Property) (Wales) Order 2022��